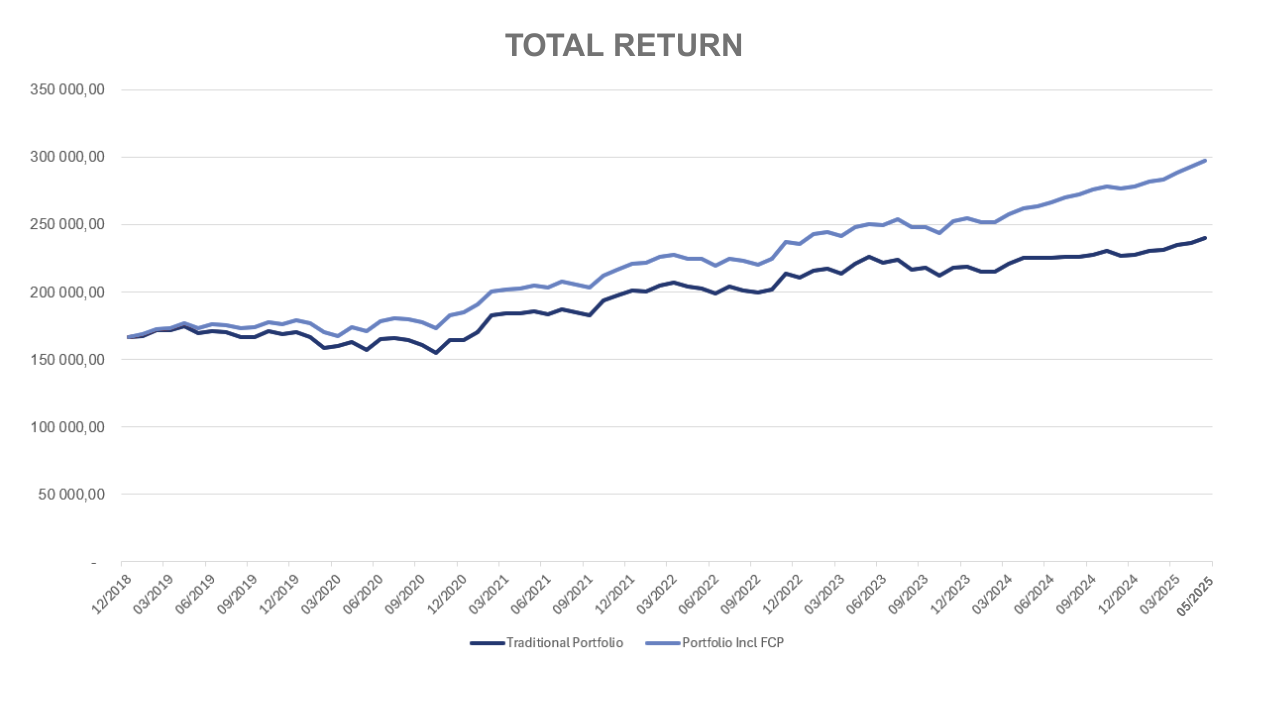

Consider two investment professionals with contrasting mandates. Jana, a CIO at a pension fund, oversees a traditional 60/40 portfolio. While historically effective, the model has recently shown increased volatility with limited reward.

David, managing a multi-generational family office, pursues the same goals, capital preservation and real returns, but through a fundamentally different allocation strategy.

Though illustrative, Jana and David represent a common divergence in institutional thinking: whether the 60/40 framework remains sufficient in a changing investment environment

Rising inflation, structurally lower real yields, geopolitical instability, and higher correlations between traditional asset classes have all contributed to a re-evaluation of portfolio construction. For many, the answer is not abandonment, but adjustment, a pivot toward an allocation that includes a meaningful slice of alternative assets.

One such approach gaining traction is a 50/20/30 model:

- 50% growth-focused listed equities,

- 20% core defensive bonds, and

- 30% alternative strategies, uncorrelated to public markets.

It’s not a prescription, but a provocation, an invitation to rethink how modern portfolios are built to navigate an increasingly complex world.